Among the more skeptical causes investors give for preventing the stock industry is to liken it to a casino. "It's merely a huge gaming sport,"olxtoto link alternatif "The whole thing is rigged." There might be sufficient truth in these claims to persuade some individuals who haven't taken the time to study it further.

As a result, they purchase securities (which can be much riskier than they assume, with far small opportunity for outsize rewards) or they remain in cash. The results because of their bottom lines in many cases are disastrous. Here's why they're incorrect:Envision a casino where in fact the long-term chances are rigged in your like rather than against you. Imagine, also, that most the activities are like black jack as opposed to position devices, for the reason that you need to use that which you know (you're a skilled player) and the current circumstances (you've been watching the cards) to improve your odds. So you have an even more sensible approximation of the inventory market.

Many individuals will discover that hard to believe. The inventory industry went essentially nowhere for a decade, they complain. My Uncle Joe missing a king's ransom available in the market, they level out. While the market periodically dives and can even perform badly for extended intervals, the real history of the markets tells a different story.

Over the long haul (and sure, it's occasionally a extended haul), stocks are the only real advantage school that has constantly beaten inflation. The reason is evident: over time, good organizations develop and generate income; they could move these gains on for their investors in the shape of dividends and give extra gets from higher inventory prices.

The patient investor may also be the victim of unfair techniques, but he or she also has some surprising advantages.

No matter just how many rules and regulations are passed, it won't be possible to entirely remove insider trading, debateable sales, and other illegal practices that victimize the uninformed. Frequently,

but, paying careful attention to financial claims will expose hidden problems. Furthermore, good businesses don't have to engage in fraud-they're also active creating real profits.Individual investors have a huge benefit around good finance managers and institutional investors, in they can invest in little and actually MicroCap organizations the large kahunas couldn't feel without violating SEC or corporate rules.

Outside purchasing commodities futures or trading currency, which are best remaining to the professionals, the stock industry is the sole widely accessible solution to grow your nest egg enough to beat inflation. Barely anyone has gotten wealthy by purchasing securities, and nobody does it by placing their money in the bank.Knowing these three key dilemmas, just how can the in-patient investor prevent getting in at the incorrect time or being victimized by deceptive techniques?

A lot of the time, you are able to dismiss the market and just concentrate on buying good companies at fair prices. But when inventory prices get past an acceptable limit in front of earnings, there's frequently a shed in store. Compare historical P/E ratios with current ratios to get some idea of what's excessive, but keep in mind that the market will help higher P/E ratios when curiosity prices are low.

Large interest prices force firms that depend on funding to pay more of their cash to develop revenues. At once, money areas and bonds start spending out more attractive rates. If investors may generate 8% to 12% in a money industry fund, they're less inclined to get the danger of purchasing the market.

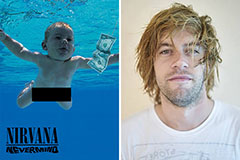

Spencer Elden Then & Now!

Spencer Elden Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!